For businesses leasing a car can take a lot of the stress out of providing staff with new vehicles as you can tailor the agreement to suit each person’s needs; changing the length of the lease, the mileage allowance and adding a service and maintenance package.

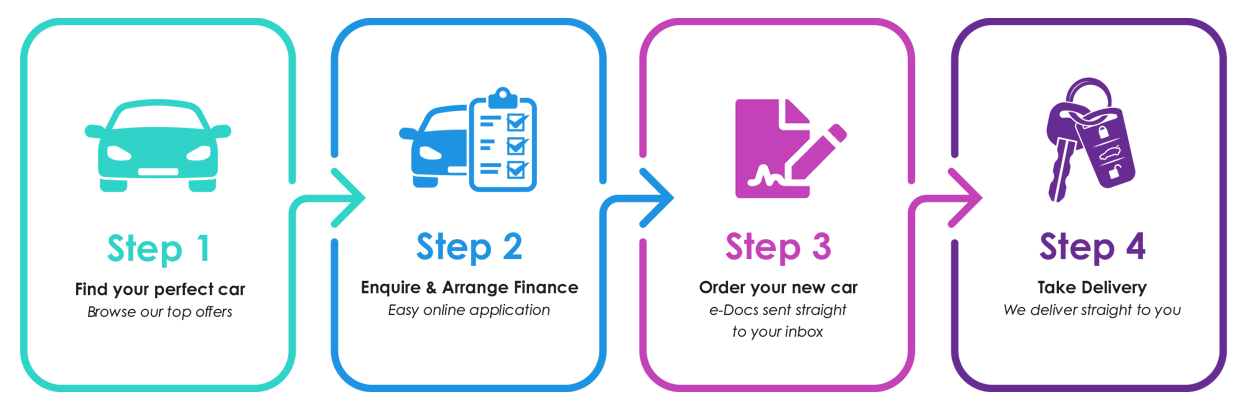

With our simple 4 step process leasing has never been easier.

Want to know more about the process? Just scroll down to the purple section at the bottom of the page and request your free guide to leasing or take a look at our guide to the business leasing application process.

Want to know more about the process? Just scroll down to the purple section at the bottom of the page and request your free guide to leasing or take a look at our guide to the business leasing application process.

Leasing cars for your business can make arranging new vehicles for your company and employees a much smoother and hassle-free process. If you decide to lease your business vehicles then you can choose from the latest models every few years without having to worry about their value depreciating.

You could be eligible for a business lease if you are one of the below:

In order to qualify for a business lease, funders may ask for proof of how long the business has been operating or proof of income. We will let you know if this is required.

Head to our business leasing page to see if you and your business are eligible for a business lease.

There are two main types of business leases we offer – Business Contract Hire Leases and Finance Leases.

A Business Contract Hire (BCH) is a form of long-term rental, that allows you to lease a vehicle for a set period of time. You can choose to pay a higher initial rental payment to reduce the cost of the following monthly rental payments.

A Finance Lease is different to a contract hire as there is the option to purchase the vehicle at the end of the lease. The full cost of the vehicle, including interest charges, may be spread over the duration of the contract or you can choose to have lower monthly payments and one substantial final payment.

It will be your responsibility to insure the vehicle for the duration of the lease. The insurance will need to be fully comprehensive.

GAP insurance will cover you if the vehicle is written off or stolen and unrecoverable, and there is a gap between what your insurer and funder value the vehicle and remainder of the lease. Head to our GAP insurance page for more information.

If you need to lease a lot of vehicles for your business you may want to look into fleet management. An external fleet management company can save you time and money.

Unless you opt for a maintenance package as part of the lease it will be your responsibility to service and maintain the vehicle, in accordance with the funder and manufacturer’s guidelines.

If you have chosen to include a maintenance package then you would need to get in touch with the provider and arrange servicing and any maintenance with them. For more details on maintenance packages take a look at our Maintained Lease Guide.

When you take out a lease you will agree to an annual contracted mileage allowance and if this is exceeded then there will be a charge for the excess mileage.

If you do need to amend the mileage during the lease, we can request a quote from the funder for you. Please be aware that most funders will not provide this until your business has had the vehicle for a year so that they have an accurate estimate of the annual mileage.

If you're looking to reduce your current fleet or are transitioning from business-owned vehicles to leased ones then we can help with selling your current vehicle.

We've teamed up with Carwow to be able to provide you with a quick and simple way of selling your current vehicles. Find out more about our partnership and the hasslefree process here.

Great Deals: We work with all of the UK’s major finance companies along with a wide network of dealers to be able to provide you with the very best deals. Take a look at our current top offers.

Stock Vehicles: We have a range of vehicles in stock to get you on the road as quickly as possible once your finance documents are completed and approved, with a lead time of three to four weeks on in stock vehicles.

Easy to Contact: There are a number of ways that you can contact us. You can call us on 0330 221 0000 or email us on hello@xcitecarleasing.co.uk. You can use the pop-up box in the bottom right of the page to talk to our team via live chat (if it’s out of hours you’ll get an email when we’re back in the office). You can click here or even schedule a call back at the best time for you by clicking on the purple phone on the bottom left of the screen.

Here to Help: From the very start of the process, through the ordering, finance documents and delivery we are here to help every step of the way. Take a look at our guides page or get in touch with our Team if you have any questions before placing your order. Once the order is confirmed you can contact our Support Team on 0330 221 0000 (option 3) or via email on to discuss any questions you have.

Straightforward Process: Leasing through Xcite Car Leasing is a simple process, you can take a look at our Personal or Business Leasing Guides or just scroll down and complete your details in the green box below to get a copy of our guide to leasing.

Years of Experience: Xcite Car Leasing has 20 years of experience in the leasing industry, so you can be sure that when you place an order with us you’re in safe hands.

Happy Customers: Don’t just take our word for the great service you’ll receive. Take a look at our review page to see what our customers are saying.

Sell Your Current Car: Xcite Car Leasing are proud to have teamed up with carwow in order to help you sell your current car before you lease vehicle arrives. They provide a quick, hassle-free, and reputable service that you can trust.

If you have any more questions about the leasing process then please take a look at our FAQs.

If you are interested in leasing a car for your business, you can get started by either contacting our friendly team for assistance or by finding a desired car that would be right for your business in our car leasing section. You’ll then be able to apply for a business leasing deal on the car of your choice.

The main reason why business leasing deals are listed as being cheaper than personal leasing deals is that businesses can claim back 50% of the VAT on the monthly lease payments and all of the VAT on any maintenance agreements they take out, so long as the car is used solely for business use. Personal deals always include the full cost of VAT, hence the higher listing price.

Yes, you can lease a car if you are self-employed. The process is slightly different to leasing for other types of businesses since it only exists as a trading medium, which means there is no difference between yourself and the company. Otherwise, the application process is the same.

Check out our self-employed business leasing guide for more information on this.

There are a few factors that are considered when calculating the cost of a business lease, including:

The type of vehicle, as different car models are worth varying amounts

The term of the lease agreement, since the longer the contract, the lower the monthly payments will be

The initial deposit amount, with the higher the deposit, the lower the monthly payments

The mileage allowance that has been agreed

Any tax implications

To analyse whether leasing a car or van for your business is the best idea, you’ll need to consider a range of variables. Firstly, consider your company’s financial situation and whether or not it’s viable to maintain the leasing payments for the duration of the suggested contract.

You’ll also need to analyse your needs for a vehicle. Do you need more than one? What size vehicle will you need? How long will you need it for? How much can you afford to pay upfront? In many cases, leasing will be a fantastic option for a business, but it’s best to consider what is right for your specific situation.

You should always think about whether a financial product is appropriate and beneficial for your business, by looking at its drawbacks.

With a Business Contract Hire agreement, some points to consider would be:

You will not own the car. The legal owner of the vehicle will be the funer, who you will make your monthly finance payments to. Your business may be the registered keeper but this may also be the funder.

You must have fully comprehensive insurance. You are responsible for this and must have an appropriate insurance policy in place, for the correct use, for the duration of the lease agreement

Terminating the contract early can be expensive. An 'Early Termination' will incur a fee from the funder, which is usually equal to between 50-100% of the remaining monthly payments

You are limited on your mileage. When you take out your contract, you will agree to a contract mileage allowance (this is divided into annual amounts for pricing purposes). If you go over this contracted allowance, you will be charged an over-miles charge – which is expressed in your contract as “pence-per-mile” – as a lump sum at the end of your contract

Company Car Tax. If the vehicle is deemed a company car, then company car tax will need to be paid by the driver. You can find out how much company car tax will be by using our Company Car Tax Calculator.

Check out one of our helpful guides or our explaination of leasing to get all your questions answered.

You can unsubscribe at any time